The Silent Graveyard

The rational actor.

From the dawn of modern economics until roughly the 1970s, Econ 101 started from the assumption that people are rational. When faced with a financial decision, for example, people (allegedly) determine the optimal outcome for their selfish interest and then act accordingly. When everyone in a society behaves this rational way, they enhance overall wellbeing thanks to the miracle of Capitalism, the “Invisible Hand.”

Starting in the 1970s, however, psychologists like the Israeli pair Daniel Kahneman and Amos Tversky questioned this basic assumption of rationality, sparking a revolution called behavioral economics. Their research showed that there never was even an illusion of rationality; if economists paid attention for just two minutes, they'd realize that "rational actors" were a fantasy born entirely from textbooks. People make irrational decisions all day every day, whether that means playing slots or buying cars like Chevy Malibus.

What You See is not All There is

In his groundbreaking book, Thinking Fast and Slow, Kahneman describes the two ways that humans think: system-one thinking and system-two thinking. System two requires more energy and is what most people would call "critical thinking." System-one thinking is our default, as it's efficient and subconscious; in lieu of critical thought, we're on autopilot in system one and rely on mental shortcuts called "heuristics." Heuristics are necessary to live—imagine how exhausting it would be if we had to deeply concentrate every time we brushed our teeth. The problem with heuristics is that many are highly irrational, rooted in biases and blindspots.

Kahneman writes about one of these cognitive blindspots, which he calls “what you see is all there is.” As the name suggests, WYSIATI means we have a tendency to mistake our limited view of the world (what we see) for complete information (all there is). One example of WYSIATI is the difficulty of overcoming a first impression. Another example, and the focus of this post, is survivorship bias: the tendency to only notice the successes ("survivors") or remaining people from a particular group and ignore the much larger original cohort in the process.

Taylor Swift, Dentists, and Taylor notSwifts

It's safe to assume that your favorite musician—say, Aly or AJ, or some lesser third choice— makes more money than your dentist does. (Actually, your dentist might make more than AJ does, but not as much as Beyoncé does.) The difference between pop stars and dentists, however, is that the majority of students in dental schools become dentists, whereas the overwhelming majority of aspiring pop stars have to get another job at some point, lest they strum guitar at the street corner into their 50s and ward off all tippers with their body odor.

Taylor Swift—whose 2023 tickets cost more than the NFL tickets of the stadiums she performs in—puts the salaries of dentists to shame. But, in making that comparison, we mustn't ignore the tens of thousands of wannabe Taylors—the Taylor notSwifts (a group I will refer to as "the silent graveyard")—if we're to compare the two lines of work. We see the "surviving" pop star, but she is not all there is.

As Nassim Taleb writes in Fooled by Randomness, "One cannot consider a profession without taking into account the average of the people who enter it, not the sample of those who have succeeded in it." Taleb's statement is obvious as it applies to Taylor Swift, the notSwifts, and dentists, but there are other, less conspicuous silent graveyards to consider.

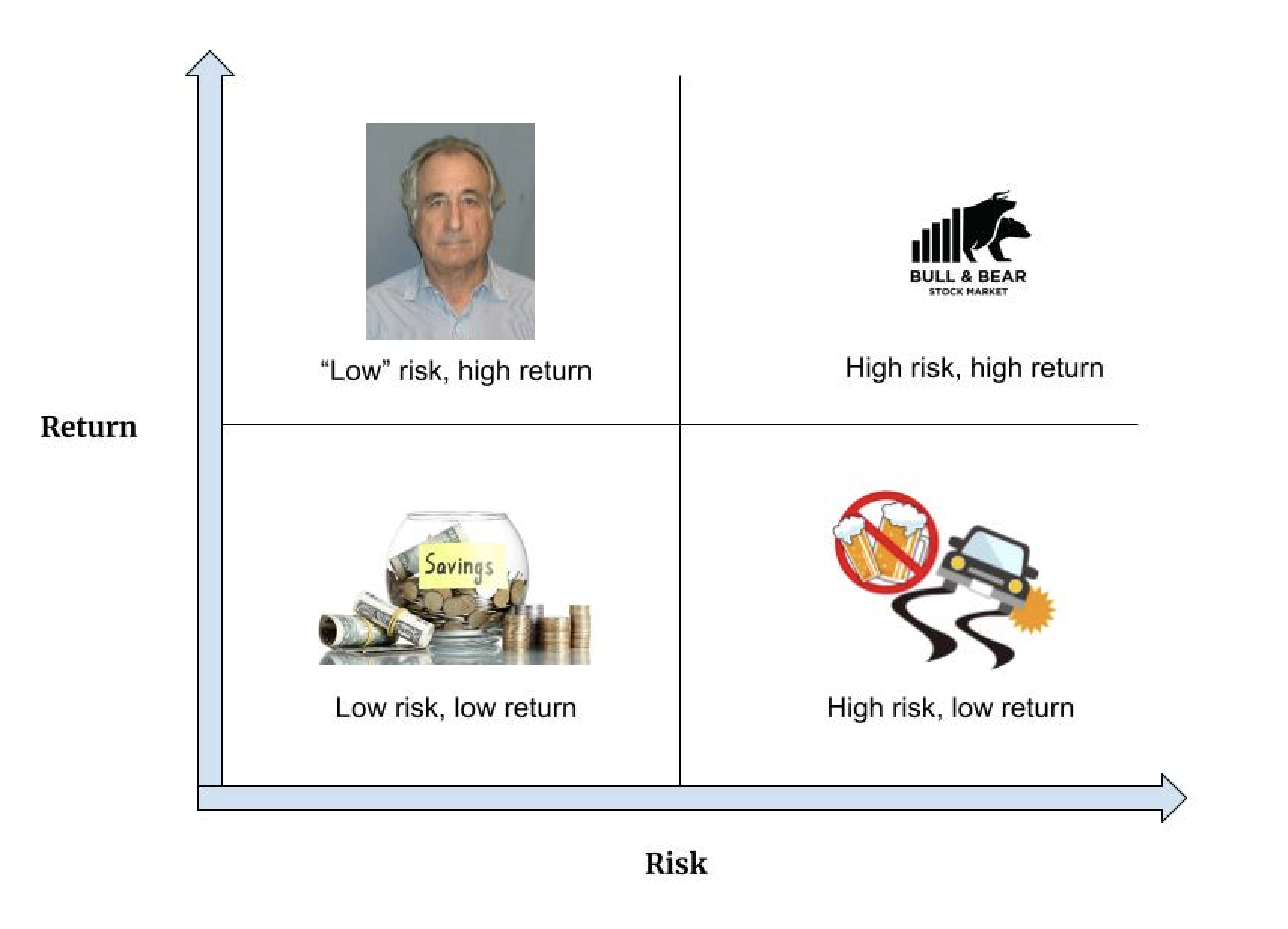

Are they Lucky or are they Bernie Madoff?

Imagine you stumble upon a $50,000 gift, but in order to take the gift you have to invest all the money by yourself. You start Googling and find a famous investor who has outperformed the stock market in each of the last 10 years—otherworldly results for non-Ponzi investors. You research and mimic her exact portfolio, wanting to make sure that your money outperforms the market index every year. You call your dad to share your strategy.

"What if she’s just been getting lucky?" he asks you.

Annoyed, you reply, "She's made billions of dollars, has written two books, and has the best investing track record of the century. She's literally beaten the market 10 years in a row. Which part of that seems lucky?" Your skeptical father might have a point, though!

Assume that professional fund managers have a 50/50 chance of beating the market in any given year (I don't care what "beat the market" means, just nod along for this paragraph). If you track 1,000 investors, 500 of them would thus beat the market after 1 year. After four years, 938 would underperform the market in at least one year. After seven years, about 7 out of 1,000 would be annually unblemished, with egos the size of the beach village where they each own homes. After 10 years, only one of the original 1,000 investors would beat the market every year. Most of the initial investors no longer run a fund.

No matter which of the original 1,000 investors is the lone survivor (and, remember, one of them is expected to be perfect based on luck alone), that person's face will be plastered on books from coast to coast. You don't hear anything from the other 999, those who comprise the silent graveyard, because they had to win all 10 coin flips to get the attention. Before entrusting all your money to the person on the book cover, remember that her odds of beating the market in year 11 are still 50/50. Taleb adds, “Mild success can be explainable by skills and labor. Wild success is attributable to variance." (It's worth noting in the age of crypto that wild success could also mean fraud.)

Career Decisions: Consult the Graveyard

Last May, as I pondered my future, I noticed a pattern: I mostly seek career advice from the more experienced people who I work with. I reflected on a different type of "silent graveyard"—those who had my job before me and self-selected out of the game and into a different job.

If you're a 24-year-old investment banker and you start to question your life satisfaction, you might turn to industry elders (read: people of 35) at the bank to ask for advice. Since they've stuck it out in banking for 10+ years, you'll probably feel worse after speaking to them, fully convinced that you are an imposter. But if you're only talking to people who “opted in” to investment banking—including those who stayed from inertia alone—you’re overlooking the massive silent graveyard of people who started before you and opted out of the industry long before 35.

If you have doubts about what you do every day, it's critical to hear from your job's silent graveyard, because those people will be almost universally happy that they quit. (If they weren't happy that they quit, they'd come back.) You’ll discover that the silent graveyard is surprisingly alive, and the world is much bigger than whatever you chose for your first or second job. What you see at work or in your friend group is not all there is.